Your New Online & Mobile Banking Experience Starts NOW!

Welcome to your new digital banking experience. For the best digital experience, use your desktop for online banking or download our new mobile app for mobile banking. All users will need to enroll to use the new system. With this upgrade you will experience an innovative and intuitive digital experience like no other.

* For the best experience on mobile please use the mobile app for enrollment, not the browser.

How to get started:

Step 1: Delete the old CWCU mobile app

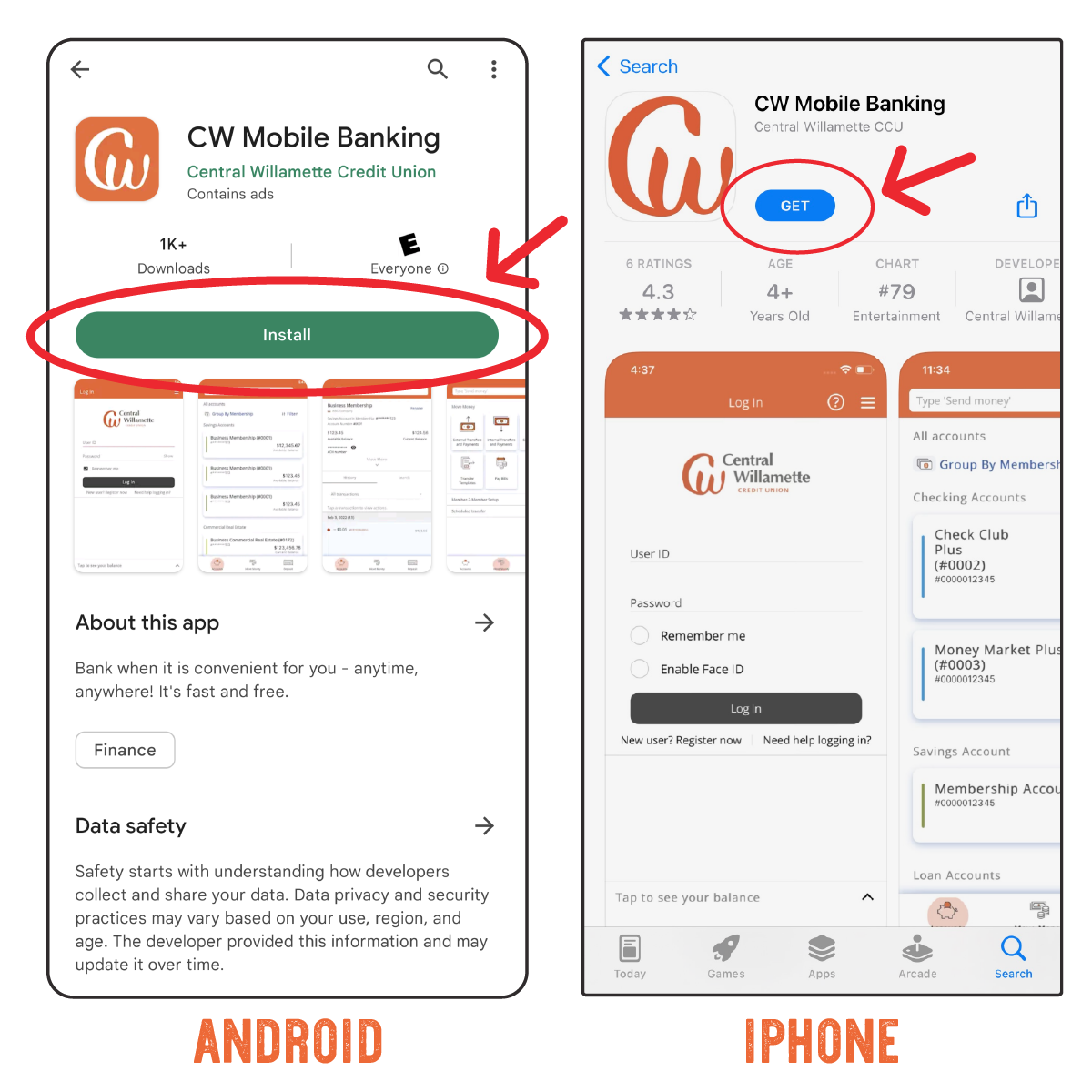

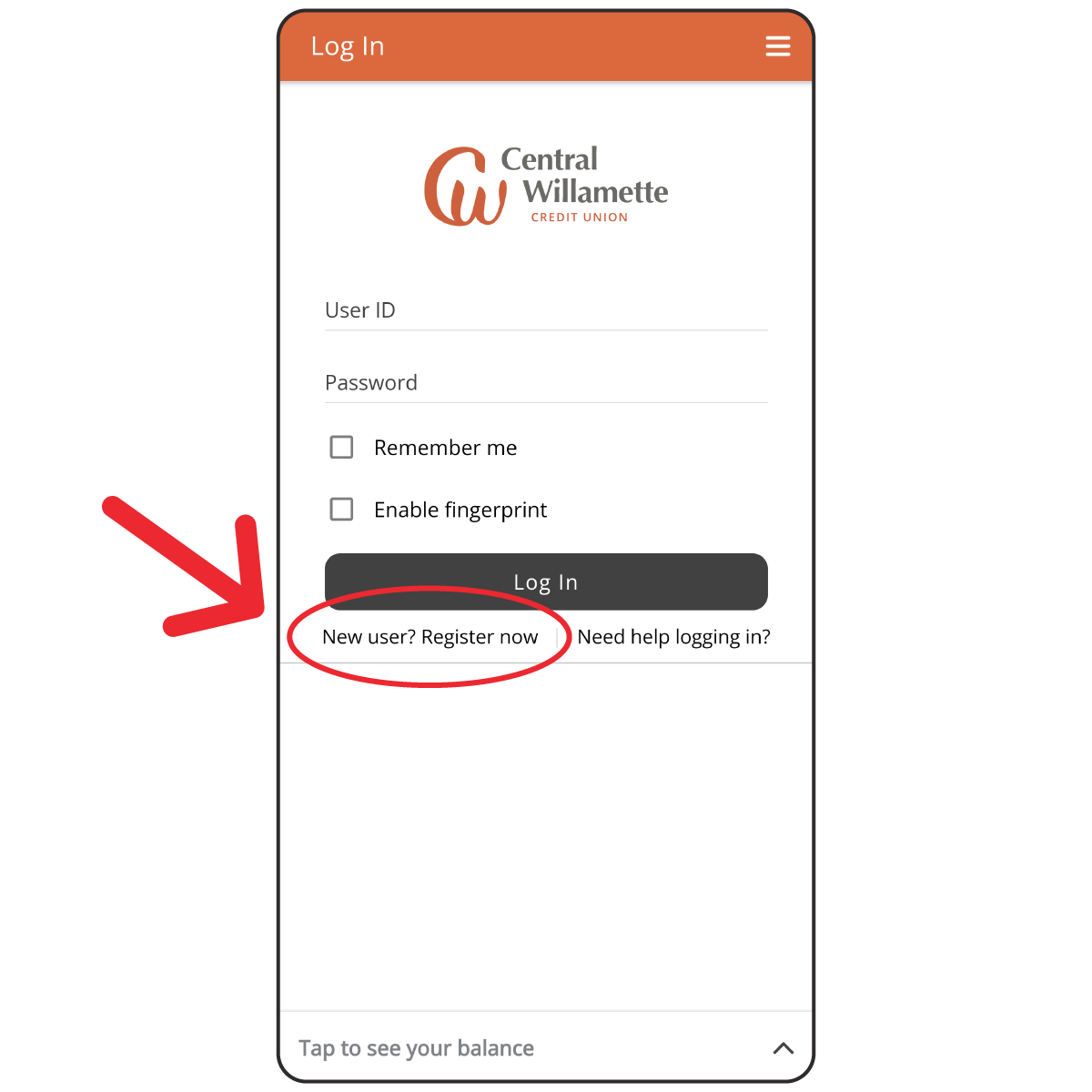

Step 2: Download the new app, now called CWCU Mobile Banking on Android or iPhone

Step 3: Register as a new user, even if you are a current member. Everyone needs to enroll again.

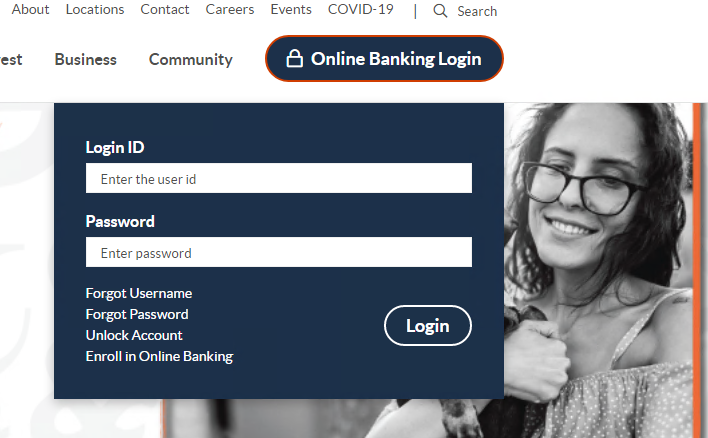

CWCU Online Banking

-

Current online banking users - go to our homepage and look for the “Enroll in Online Banking” link to enroll into our new online banking platform. New users can enroll here as well. This is a quick and easy process and requires you to create a unique login.

- Your banking information will transfer to the new online banking platform.

- Any accounts associated with you will show under your profile. Now you’ll be able to see all of your accounts – both consumer and business, at once in a seamless and easy way.

- If you have assigned nicknames to your accounts, you will need to re-establish your nicknames in the new system.

E-Service Set Up

To set up e-Statements, Mobile Deposit, BillPay, or Online Banking click here.

Bill Pay and e-Bills

*How is Bill Pay affected by the upgrade? Your Bill Pay payees and scheduled payments will transfer to the new system and be available to the primary account holder when they log in on or after November 7, 2022.

*How are eBills affected by the upgrade? You will need to reestablish all eBills on the new, enhanced, system after November 7, 2022.

Connecting Budget-Tracking and Other Software

We understand that some of our members may experience difficulty connecting their budget tracking software to our online banking system. Third-party software such as Intuit QuickBooks, Quicken, Mint, Simplifi, Plaid, YNAB (You Need a Budget), Rocket Money, Venmo, and others may have issues updating their accounts and transactions. We want to assure our members that we are aware of these challenges and are working to resolve them.

Please note: While we do not have direct relationships with these software providers, we have provided some general troubleshooting steps below that may resolve the issue. If you are still having difficulty, please reach out to us for further assistance.

General Troubleshooting:

- Contact Information: Make sure your contact information, specifically your personal phone and cell number, is up to date.

- Member Number: Some software may ask for your member number, please use online banking username instead.

- Account Number: Some software may ask for your account number, please use your ACH number (viewable on the Accounts page in online banking) instead.

- Account Names: Establish a unique name for each share and/or loan across all your accounts (More > Account Settings)

- Preferred Account: If you have multiple personal and business accounts, some budget tracking software will only recognize the checking/savings accounts in the "preferred account". The "preferred account" can be set in our online banking system, found in the profile-switcher (upper-right corner). If you want to link your personal accounts to the budget software, set the preferred account to "All Personal Memberships" and wait about 30 minutes before attempting to connect again. If you want to link your business accounts to the budget software, set the preferred account to "All Business Memberships". If you need both personal and business accounts in your budget software, please contact our Business Services Department for a separate workaround.

- Reset Connections: Re-establish connections by inactivating, disconnecting, and/or removing existing credit union accounts from your budget software and then re-establishing the connection(s). Please refer to your software's specific instructions before removing any existing accounts to ensure that you don't delete information you wish to keep.

- Transaction Upload: Some software supports uploading transactions. This is a manual fallback method, but should work if your software supports file imports. Transactions can also be downloaded from our online banking in various file formats such as CSV, QFX, OFX, and QBO. These can be accessed through Accounts > [click a specific account name] > click the Export icon.

Vendor-Specific Troubleshooting:

- QuickBooks Online: Should work as expected.

- QuickBooks Desktop and Quicken: Connections to your accounts may require additional setup. QuickBooks Desktop connects using "Direct Connect" or "Web Connect". Direct Connect will connect your personal and business accounts. If you are using Web Connect, change the connection type to Direct Connect. Please refer to QuickBooks' support for assistance.

- Mint: Should work as expected.

- Simplifi: Should work as expected.

- Venmo: Venmo uses Plaid to connect to the credit union. Refer to the Plaid section for troubleshooting tips.

- Rocket Money: Rocket Money uses Plaid to connect to the credit union. Refer to the Plaid section for troubleshooting tips.

- YNAB (You Need a Budget): When attempting to connect through YNAB, enter your online banking username where NYAB asks for their Member Number. Additionally, YNAB uses Plaid and MX to connect to the credit union. Refer to those sections for troubleshooting tips.

- Plaid and MX: Plaid is used by budget software and other banks to connect to the credit union. Follow Plaid's instructions and use the ACH Number (found in online banking's Account page next to each share - click the eye icon) when asked for the Account Number. IMPORTANT: refer to the information about your “preferred account” in the General Troubleshooting section, above.

All users should carefully review all downloaded transactions after completing the migration to ensure no transactions were duplicated or missed in the register. If you are experiencing some issues with accessing Intuit, please note that because of the multiple variations of Intuit products, we are continuing to address access as quickly as possible.

We appreciate your patience in the meantime.

Have questions? You can also call us at (541) 928-4536 or visit one of our conveniently located branches.

Business members can call the CWCU Business Services team at (541) 918-7526. The CWCU team is ready to help you!

Please Note: To continue to provide you with the best service possible, please take a moment to update us with your latest contact information using this easy link.

Frequently Asked Questions

General Questions

We want to provide you with the best digital banking experience possible to make your life easier, and this upgrade is designed to do just that.

Yes, you need to download a new app. The new app is called CWCU Mobile Banking on iPhone and Android. Download the app and register as a new user, even if you are a current member. Everyone needs to enroll again.

* For the best experience on mobile please use the mobile app for enrollment, not the browser.

It helps to avoid issues. It is extremely important that Central Willamette has your current contact information. The first time you attempt to login after the upgrade, we will rely on that information to validate your account and establish new login credentials. If your information is not up-to-date, you may experience challenges logging in for the first time.

Bill Pay and eBills

eBills is a service that retrieves your billing statements from a biller. This is distinctly different from a payee that you create in Bill Pay. You will need to reestablish all eBills on the new, enhanced, system.

Your Bill Pay payees and scheduled payments will transfer to the new system and be available to the primary account holder when they log in to the new system.

Payment visibility. If you are a bill pay user who has scheduled payments, those payments will be visible to the primary account owner only. If you are the sole owner of your membership account, you have nothing to worry about. But if you share your credit union membership with another person, it is important to understand that the primary member will see and manage those payments inside of bill pay. If you prefer the joint owner to manage the bill payments, the joint owner should establish the payees and payments using their own login credentials.

- Payee visibility. With the move to individual logins, bill pay payees will be transferred to the primary account holder. If your credit union account has a joint owner, they’ll no longer see the existing payees after the upgrade. However, they can establish new payees associated with their new login.

- Payee history. Like the payees themselves, the history of payments made to those payees will be visible to the primary account holder.

Re-establish your external transfers. If you transfer money from your credit union accounts to an outside institution, you will need to re-establish those relationships after the upgrade. Be sure to review any upcoming payments you may want to make ahead of the upgrade date.

If your recurring payment falls on a weekend or holiday, the funds will be withdrawn from the account the prior business day.

Bill pay profiles for trusts and other entity accounts may not have tranfered to your profile. Once logged in to the new online banking, please check bill pay for your payees and if you would like your profile assigned to you, please send us a message.

Account Information

- Primary, joint, and others. Your credit union account may have a single owner. Alternatively, your account might have a joint owner, several joint owners, and other types of ownership levels. Today, all of those people share the same login to your account. But after the upgrade, each person will have their own individual login and they will see all the accounts to which they have access at Central Willamette, even across multiple memberships.

- Important considerations. It’s easy to forget who the primary account owner is. A common scenario is a person who owns an account may have a spouse who manages the finances. After the upgrade, the existing bill pay payees, scheduled bill payments, eStatements, and scheduled transfers will be visible to the primary account owner only. But keep in mind, new bill pay payees, scheduled bill payments, and scheduled transfers can be created by the joint owner.

Yes, you will need to enroll as the new system is person centric and you will have your own profile.

Many of our members will find it beneficial to select a new username. We’re asking folks to avoid using member numbers as usernames and to choose something easy to remember. The coolest thing about this upgrade is that if you have multiple accounts, you’ll no longer need multiple logins. All account information can be accessed with just one username and password combo!

We know some things are better left un-shared. With our new setup, you’ll no longer have to wade through information that doesn’t pertain to you. You’ll see the accounts you’re on and not have to worry with anything else.

We will ask some personal questions in the registration and enrollment process, but there’s no need to worry; these questions will pertain to each individual member – not just to the primary member.

- No more shared logins. Today, each membership has a unique login. After the upgrade, each person will have a unique login. This means primary and joint owners will have their own unique login and each person will see all the accounts they are listed on.

- Single login across your businesses. If you're a business owner, a single login will allow you to switch between all your personal and business-related accounts.

- Important considerations: Make sure you know who has access to your accounts. If your account has a joint owner (or multiple), they'll be able to view and/or transact on that account. Also, make sure you know who the primary account owner is. The primary owner will be assigned to any bill payees, scheduled bill payments, eStatements, and scheduled transfers.

eStatement access. If you are the sole owner on your credit union membership, eStatements will be available as always. If you share your membership with a joint owner across all of your savings and checking accounts, they’ll also be able to access the statement for that membership. However, if the joint owner has limited access (access to the savings, but not checking, for example), only the primary owner will be able to access eStatements for that membership.

We’re doing all the heavy lifting we can to make this as easy as possible for our members. Your transaction history won’t change and neither will your statements. If you’ve previously added billers into Bill Pay, those will come over too. When the time is right, we will ask that you re-enter information for individuals you send money to, but even that will be easier than it has in the past.

The only impact is that these transactions will now be processed by CWCU by 12am each day.

Business Members

We’re rolling out the red carpet for our business members with this upgrade; they will see the most changes yet will get all the help they need until they’re comfortable with the new layout. We’re using new technology enabling our members and employees to participate in screen-sharing and co-browsing to give a true VIP experience - that means we can walk you through screen-by-screen until you’re ready to fly solo.

Manage your personal accounts and business accounts with one login. Set up sub-users to help you manage your business. Setup authorization workflows to help you manage transactions. Sign-up ACH payments for your accounts payable process. Sign-up for desktop capture to scan multiple check deposits.